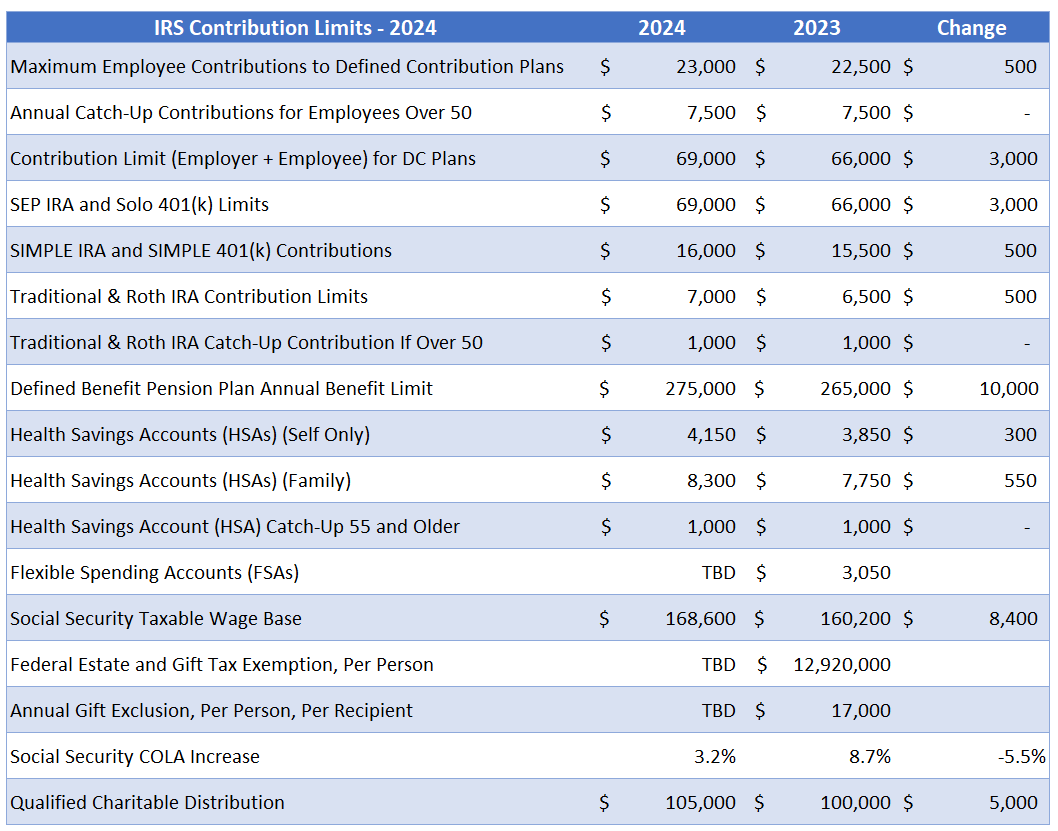

New 2024 401k Limits – The income thresholds to be eligible for a Roth IRA are also higher in 2024. For single and head-of-household taxpayers, the income phase-out range is between $146,000 and $161,000, up from between . Inflation-fueled tax breaks, boosted contribution limits, and SECURE Act 2.0 changes create strategic opportunities for advisers to help clients save more, withdraw smarter, and maximize retirement .

New 2024 401k Limits

Source : meldfinancial.com401k Contribution Limits For 2024

Source : thecollegeinvestor.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.com2024 401(k) and IRA contribution limits announced! – Personal

Source : www.personalfinanceclub.comHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.com2024 IRS 401k IRA Contribution Limits | Darrow Wealth Management

Source : darrowwealthmanagement.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com2024 Contribution Limits Announced by the IRS

Source : www.advantaira.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com2024 Tax Tips: New 401(k) limits

Source : www.cnbc.comNew 2024 401k Limits 401(k) Contribution Limits in 2024 Meld Financial: applicable to dollar limitations for retirement plans and the Social Security wage base for 2024. Many of the limits that applied to the 2023 plan year changed for the 2024 plan year. Employers . Choose the provider (brokerage) where you want to open your new Roth or traditional IRA and make Internal Revenue Service. “401(k) Limit Increases to $23,000 for 2024, IRA Limit Rises to $7,000.” .

]]>